Introduction to Kautilya and his Arthashastra

Kautilya was a learned, ethical, wise, experienced, secular, progressive, independent and original thinker. He believed that poverty was death while living. His Arthashastra is a manual on promoting Yogakshema—peaceful enjoyment of prosperity—for all the people. It is shown that his approach is more suitable to our economy than the currently adopted western approach. He understood the economic system as an organic whole with interdependent parts. He undertook an in-depth and detailed analysis of each part at the micro level without losing sight of the macro goal of engineering shared prosperity. He believed in the power of persuasion, moral and material incentives and not in coercion or force to elicit effort. He designed material incentives in such a way that no crowding-out occurred, that is without weakening the moral incentives. He advanced a holistic yet logical and comprehensive approach to bring shared prosperity.

In fact, a stakeholders-model in which the businessmen, workers and consumers share prosperity, is discernible in his Arthashastra. He relied both on the invisible hand (the market) and the direct hand (principles, policies and procedures) to enrich the people. Kautilya was deeply influenced by the Mahabharata (3102 BCE) and it appears as if it had happened in not too distant a past. Secondly, Rao (1973) points out that the measurements used in the Arthashastra are very similar to those prevalent during the Sindhu-Sarasvati Civilization (2600 BCE-1800 BCE).1

According to the new research, Chandragupta Maurya ruled around 1534 BCE and not during the 4th century BCE. The preponderance of emerging evidence indicates that Kautilya wrote his Arthashastra—science of wealth and welfare—several centuries earlier than the fourth century BCE which has been advanced by the Western Indologists. They had taken upon themselves the selfless and tortuous task of dating, without any margin of error, all the historical events, such as the Aryan Invasion Theory and providing authentic interpretations of our ancient texts. They really need their well-deserved retirement from this demanding responsibility and leave it to the native amateurs.

Kautilya was far-sighted, foresighted, ethical but not very religious, believed in designing an efficient organizational structure but was not a bureaucrat. Kautilya: The True Founder of Economics The following table lists some of the concepts innovated and used by Kautilya. It also provides the time-periods of their re-emergence.

Table 1: Concepts Developed and Used by Kautilya

On the other hand, Adam Smith did not innovate a single concept in economics. Barber (1967, p17) observes, “Little of the content of The Wealth of Nations can be regarded as original to Smith himself. Most of the book’s arguments had in one form or another been in circulation for some time.”

Kautilya as a One-Man Planning Commission and More

Kautilya's Arthashastra is comprehensive, coherent, concise and consistent. It consists of three fully developed but inter-dependent parts.

(a) Principles and policies related to economic growth, taxation, international trade, efficient, clean and caring governance, moral and material incentives to elicit effort and preventive and remedial measures to deal with famines.

(b) Administration of justice, minimization of legal errors, formulation of ethical and efficient laws, labour theory of property, regulation of monopolies and monopsonies, protection of privacy, laws against sexual harassment and child labour.

(c) All aspects of national security: energetic, enthusiastic, well trained and equipped soldiers, most qualified and loyal advisers, strong public support, setting-up an intelligence and analysis wing, negotiating a favourable treaty, military tactics and strategy, and diet of soldiers to enhance their endurance.

II Kautilya’s Ethics-based economics Versus Modern Self-interest based Economics

Modern Economics Based on Self-interest: Complex contracts are written to safeguard against potential harm that might be caused by the partners’ opportunism. It seems that propensity for opportunism is the dominant phenomenon everywhere. Economists and organizational scholars believe that it is not possible ex ante to differentiate a trustworthy person from an untrustworthy one, so it is prudent to adopt a ‘calculative’ approach to trust, that is, treat trust as a risk and suggest taking necessary protective measures.

Kautilya’s Ethics-based Economics: Ancient sages realized that genuine trust was an ethics-intensive concept since non-violence, truthfulness, honesty and benevolence were the foundation for trust. Kautilya accepted that insight wholeheartedly. That is, trust flourished only in an ethical environment. How to make sure that children grow-up to be ethical adults? Kautilya suggested teaching ethical values at an early age. Kautilya believed that dharmic (ethical) conduct paved the way to bliss and also to prosperity. That is, according to Kautilya, a society based on contracts alone is less productive and more anxiety prone than the one based on conscience and compassion. If the social environment is predominantly ethical, there is less of a need to take defensive measures to protect against opportunism. He emphasized ethical anchoring of the children for replacing the ‘culture of suspicion’ with a harmonious and trusting one.

Critical Role of Trust in a Knowledge-based Economy: Trust may be an intangible asset/good but has the most tangible role in creating and sustaining the social, economic, cultural and political structures. It is the brick and mortar to the building of inter-personal relationships. In an industrial economy, trust (a) reduces transaction costs by reducing opportunism, enhances a feeling of wellness by reducing anxiety and (b) also might increase GDP by reducing the demand for lawyers and turning them into engineers.

Trust is the most valuable asset in a knowledge-based economy. Both creation and sharing of ideas depend on trust. The distinguishing characteristic of a knowledge-based economy is a frequent sharing of tacit knowledge and exchange of information among the cognitive labor. As soon as a person codifies his/her tacit knowledge everyone has access to it. Knowing this fact a person will share tacit knowledge only if s/he is sure of not getting fired. Creating ethical-based trust is the key to realizing all the potential gains from creating and sharing of knowledge.

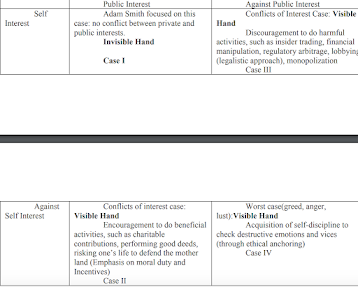

Adam Smith focused only on invisible hand. But economists now deal with cases II and III also. Kautilya was the only one discussed all four cases.

Table 1: Interests and Incentives

Dharma and Prosperity

Since the mid-90s, a considerable amount of intellectual effort has been devoted to study the nature of relationship between institutions, good governance and economic growth. One group of economists argues that institutions are the most important determinant of economic growth. In fact these economists call institutions as the ‘deep determinants’ of growth. For example, Dani Rodrik, Arvind Subramanian, and Francesco Trebbi (2004) (2004) claim, “This exercise yields some sharp and striking results. Most importantly, we find that the quality of institutions trumps everything else.”

The other group of economists gives primary importance to good governance and only secondary to institutions. Edward Glaeser, Rafael La Porta, Florencio lopez-de-Silanes and Andrei Shleifer (2004, p 298) conclude, “But institutional outcomes also get better as the society grows richer, because institutional opportunities improve. Importantly, in that framework, institutions have only a second-order effect on economic performance. The first order effect comes from human and social capital, which shape both institutional and productive capacities of a society.”

Apparently, economists, even now in 21st century, are debating about the relative importance of institutions versus to that of good governance. Kautilya settled this debate more than two thousand years ago. He argued that good governance created opportunities and institutions allowed them to be availed of implying that both were essential to prosperity and it was futile to compare them. However, according to Kautilya, most important was the ethical environment, which improved the quality of both.

Kautilya on Importance of Institutions: Kautilya believed that poverty was a living death and also not conducive to the practicing of ethical values. He argued that maintenance of law and order was a prerequisite to economic prosperity. He (p 108) observed, “By maintaining order, the king can preserve what he already has, acquire new possessions, augment his wealth and power, and share the benefits of improvement with those worthy of such gifts. The progress of this world depends on the maintenance of order and the [proper functioning of] government (1.4).

Importance of Good Governance: Similarly, according to Kautilya, good governance was needed for prosperity. He (p 149) suggested, “Hence the king shall be ever active in the management of the economy. The root of wealth is economic activity and lack of it brings material distress. In the absence of fruitful economic activity, both current prosperity and future growth are in danger of destruction. A king can achieve the desired objectives and abundance of riches by undertaking productive economic activity (1.19).”

Kautilya’s ideas if expressed in today’s language imply that quality of institutions reduced risk and good governance increased return on investments. This may be captured by the following figure.

The risk-return possibility frontier, AB shifts to A'B' and also becomes more concave. That makes it possible for an investor to move from point E to point E'. U1 and U2 are the indifference curves. Two points may be noted. Kautilya’s insights may be expressed not only as a shift in the feasibility frontier but also as a change in its curvature.

Table 8.1: Conceptual Framework on Dharma and Prosperity

Conduct and Prosperity: Kautilya argued that a king, whether he fulfilled his moral duty or followed his enlightened self-interest, had to enrich his subjects. However, he understood the major differences between them: according to the moral duty, the king wanted to enrich the public whereas according to the enlightened self-interest, the king had to enrich the public. He preferred an ethical king rather than a king motivated by his enlightened self-interest. The following figure may be used to express his ideas on comparing the relative consequences of following moral duty to those of enlightened self-interest.

AB is the income possibility frontier. Point M denotes the combination (high public income, low king’s income) if the king follows his moral duty. Point F denotes the combination (very low income for the public, very high income for the income) when the king is immoral. Point S denotes the combination (somewhere in between points M and F) when the king is amoral, that is, follows his enlightened self-interest

Kautilya specified three possibilities. (i) His argument based on moral duty implied that a rajarishi (king, wise like a sage) would take a very modest amount for his own consumption, that is, point M would not be too far away from point A on the vertical axis.8 Such a king would promote ethical behavior, use almost all the tax revenue on the provision of public goods and welfare programmes and follow judicious polices to encourage economic growth. As a consequence there would be both spiritual and economic (i.e. over time the income possibility frontier would shift outwards) enrichment of his subjects.

(ii) A king motivated by his enlightened self-interest would promote public interest to the extent that it promoted his own interest, that is, promotion of public interest was merely a means to the promotion of his own interest (whereas in the above-mentioned case (i) promotion of public interest was an end in itself). Kautilya’s argument based on enlightened self-interest implied that the king might choose a point like, S.

(iii) According to Kautilya, a myopic and unethical king would try to grab almost all the resources for himself. This is indicated by point F on the possibility frontier. Such a king would ruin himself as well as the economy. This is comparable to Olson’s ‘roving bandit’. Since such a king would leave very little for the public, that is, point F would be very close to point B on the horizontal axis. Such extortion and myopic behavior would adversely affect future economic growth (i.e., most likely, the income possibility frontier would shift inwards).

Minimal and Maximal Economic Growth: Thus two types of growth models are discernible from The Arthashastra: one based on moral duty and the other based on enlightened self-interest. Kautilya preferred the one based on moral duty since that would lead to the highest possible growth in income of the people. Whereas the growth rate based on enlightened self interest was the minimum required of a king to stay in power. That is, so long as the king managed to keep income above the poverty line, y > yPl, (the poverty level of income) and judicial fairness, J > JR at a reasonable level of fairness (that is, punishment somewhat proportionate to the crime and low probability of judicial errors), there would be law and order and the king could stay in power. However, the king had to provide some infrastructure and have pro-growth policies to promote economic growth. Thus, even in this model, both institutions and governance were needed for generating economic growth and institutions alone could not be labelled as the ‘deep determinant’ of growth.

III Ethical Anchoring of Children

According to Kautilya, it is better to pass on good values rather than ill-gotten wealth to the younger generation. If we insist on labeling reforms as the ‘first generation’ reforms and ‘second generation’ reforms, Kautilya might suggest a more appropriate distinction: to undertake reforms of the ‘old generation,’ which is running the country at the moment and whose unethical behavior could be casting a long shadow on the character building of the younger generation. Kautilya (pp 155-156) wrote, “‘There can be no greater crime or sin’, says Kautilya, ‘than making wicked impressions on an innocent mind. Just as a clean object is stained with whatever is smeared on it, so a prince, with a fresh mind, understands as the truth whatever is taught to him. Therefore, a prince should be taught what is dharma and artha, not what is unrighteous and materially harmful (1.17).” In a democratic country every child is a prince. Moreover, he (p 123) pointed out, “Whatever character the king has, the other elements also come to have the same (8.1).”

IV Kautilya’s Insights

(a) An ounce of ethics was better than a ton of laws. Ethical anchoring could be more effective in preventing systemic risk than a heap of rules and regulations. (b) Principles were only as good as the people who practiced them, and policies were only as good as the people who formulate and implement them. (c) Material incentives should complement and not substitute moral incentives so that there is no crowding- out. (d) Education should include ethical education also. Secular values, such as non-violence, honesty, truthfulness, compassion and tolerance do not violate the separation between religion and state. (e) Market failure is bad, government failure is worse but moral failure is the worst since moral failure is true cause for other failures. (f) Ethics and foresightedness could improve governance and bring sustainable prosperity for the whole of humanity. (g) Sound organizational design could complement the ethics-based approach by enhancing specialization and reducing the scope for conflict of interest situations. (h) Wisdom is the most valuable asset and knowledge-management is a subset of management by wisdom. References: Kautilya: The True Founder of Economics, 2014, Vitasta Publications, New Delhi, India

Article courtesy: https://ignca.gov.in/invitations/About_the_lecture.pdf